In recent years, there has been a surge in the surplus funds recovery industry, as people have started to recognize its potential. As a result, many individuals are now turning to recovery companies to assist them in retrieving their funds.

This trend has also attracted the attention of more investors, who are drawn to the surplus funds recovery business due to various factors such as heightened awareness of unclaimed funds, the abundance of opportunities available, and the ease of entry.

What does this boom mean for the industry and those involved?

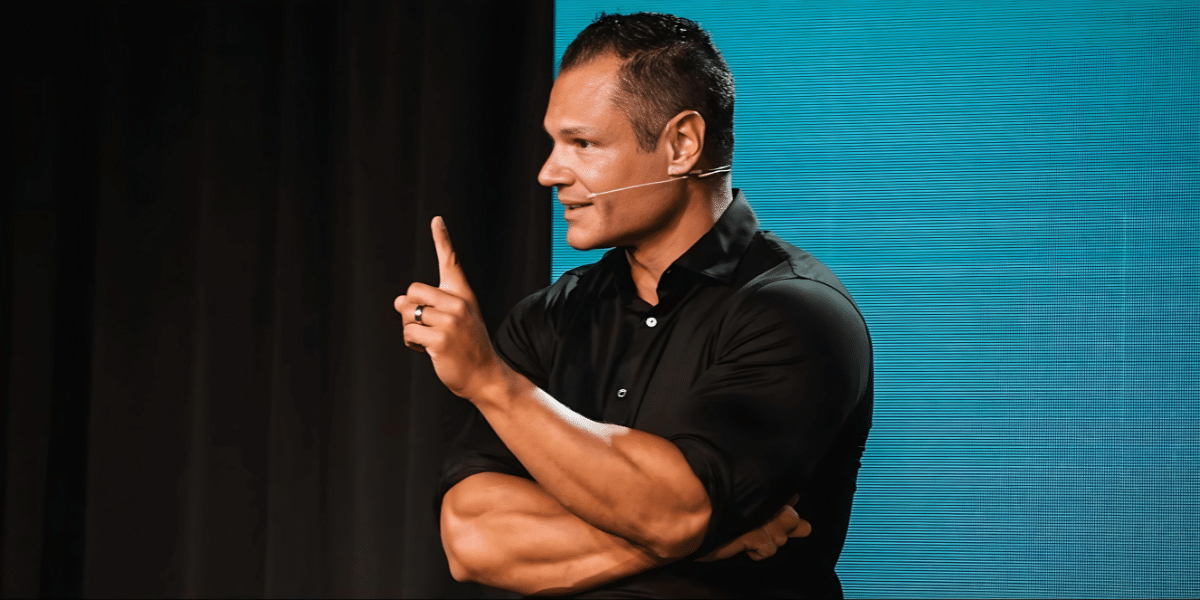

According to Spencer Vann, the founder of Surplus Cashflow, the surplus fund recovery industry has been long neglected, however, the tides are turning. Over the past five years, there has been significant growth in the industry as more individuals recognize its potential for profitability, a trend that is expected to rise in the years to come.

When Spencer was just 19 years old, he attended a local meetup group where he first heard about Surplus Fund Recovery. It was then that he discovered it was possible to recover money that had been lost to the government. This inspired him to create an education company called SurplusFund.com, which drew in 5,000 students and recovered an impressive total of $500,000,000 in lost funds.

Spencer Vann states, “Right now, investment returns are plummeting because of the recession. Mass layoffs are happening because of the recession. But surplus fund recovery is making more money than ever, which has made it so attractive.”

Those who run a surplus funds recovery business are essentially giving money away without any cyclical economic impact. During times when the economy is down, Spencer notices an increase in demand for his services because more people need financial help, stating, “Even when the economy is up, people still need money. It’s not like people stop wanting money.”

This unique, recession-proof aspect of surplus funds businesses sets them apart from Amazon-based businesses, where their entire business model is based on e-commerce, making them particularly susceptible to the impacts of a recession. On top of that, an economic downturn could also have an adverse effect on Amazon’s supply chain and logistics, potentially leading to shipping delays or even product shortages.

The upcoming future of the surplus funds recovery industry is promising as more businesses and individuals become aware of the potential value in unclaimed or forgotten assets. This has led to an increase in efforts to locate and recover surplus funds, with the help of technology and specialized services.

As a result, more surplus funds are being returned to their rightful owners. According to Spencer Vann, “You don’t have to purchase or manage inventory, run or pay for advertising, create a website. There’s nearly 100 billion dollars in lost money, and it’s easier to claim than ever before.”